When it comes to borrowing money, taking out an installment loan is the easy part. Provided you meet your lender’s eligibility criteria, you can find convenient online loans in a pinch.

What’s harder is paying it all back on time, especially in times like these. When the cost of living is higher than ever, your budget might already be stretched to its limits.

To make sure you don’t sign on for something you can’t afford, check out the tips below. Anyone will benefit from this guide — whether you start your application today or are in the middle of repaying your loan online.

Rely on loans in emergencies only

Let’s face it — it’s easier if you don’t have to worry about paying back a loan, so do what you can to limit how often you borrow.

Changing the way you think about online loans can help you understand how they fit into your finances. They aren’t meant to boost your budget when you want to splurge on new tech or take care of regular maintenance. Online personal loans are designed to help you with financial emergencies.

A financial emergency can be different for everyone, but they generally involve urgent, unexpected expenses you can’t postpone until you save up. Like, let’s say, your toilet starts overflowing, and you need to call a plumber to fix the root cause. Or your cat eats a string, and you have to pay for exploratory surgery to remove it from her digestive tract.

Read your terms and conditions front to back

You can’t skip your terms and conditions. This is where all your rights and responsibilities are.

By reading them, you’ll know these crucial elements about your loan:

- Cost: Your contract should share your APR as well as the interest rate, fees, and other charges that go into this number.

- Timing: Your terms outline your expected payment sizes, their due dates, and the total length of time before you pay back the last cent.

You can refer to your contract to remind yourself of any details in the middle of your loan. However, you should read this contract carefully before you sign anything. This helps you determine if the offer is something you can afford.

Treat your loan like an essential expense

Once you move into your repayment period, you should prioritize it like any essential expense. Essential expenses consist of monthly spending you can’t avoid without serious consequences, like rent, utilities, or insurance premiums.

Your loan is just as important as these essentials, but not more so — if you can’t juggle rent and your loan payments, this isn’t the right option for you.

Cut discretionary spending from your budget

Successfully juggling all your essentials and your loan is easier when you edit your budget, removing discretionary spending throughout your term.

If you aren’t sure what to say “sayonara” to, look for inspiration in the list below:

- Subscriptions

- Dining out and takeout

- Concert or movie tickets

- Gardening upgrades, plants, or flowers

- Vacations and weekend getaways

Double up on payments whenever possible

With a sharp eye, you can spot a wellspring of savings in your budget by eliminating discretionary spending. Put all of this towards your loan, even if this goes above and beyond your scheduled repayments. Early or pre-payments can help you pay off your debt faster if this cash goes towards your principal.

Before you commit to overpaying your loan, you’ll want to check that there are no pre-payment penalties. While some legitimate loan companies encourage borrowers to make as many payments as they can, others will fine you for paying outside your agreed upon schedule.

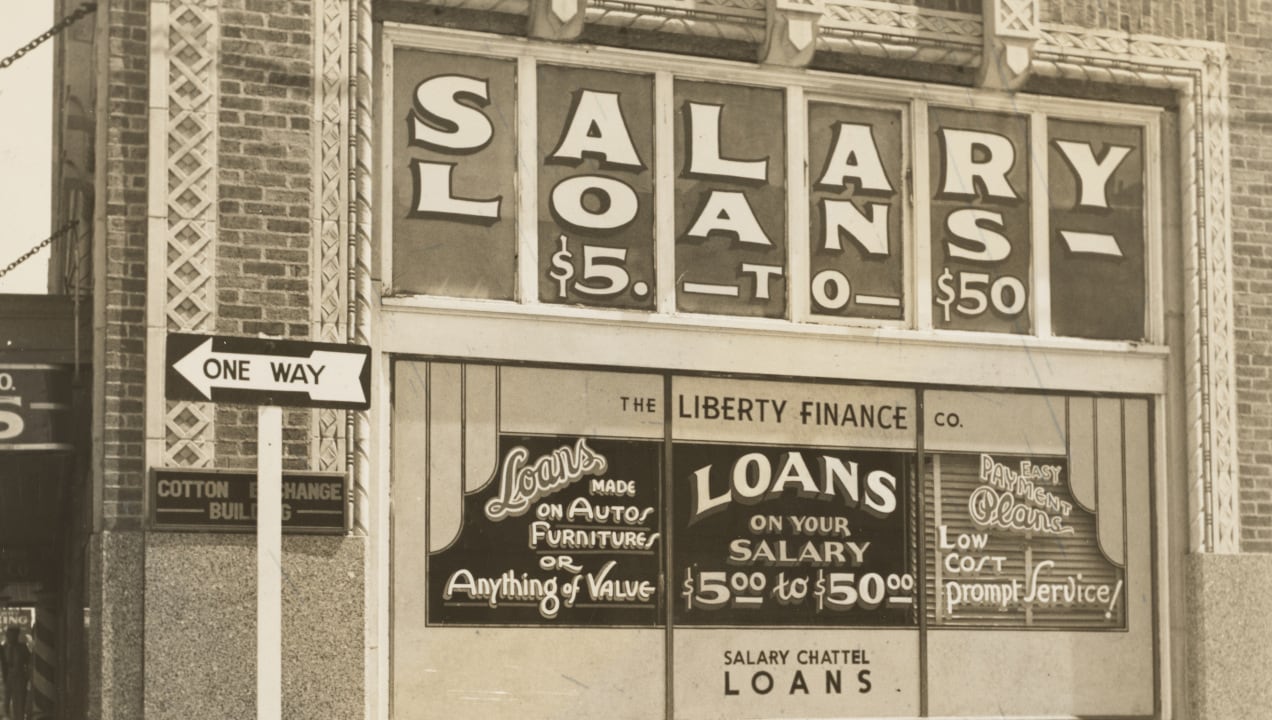

Top photo by The New York Public Library on Unsplash