The crypto currency market has felt like a wild rollercoaster ride since the Trump administration declared its intention to make the United States the crypto capital of the world.

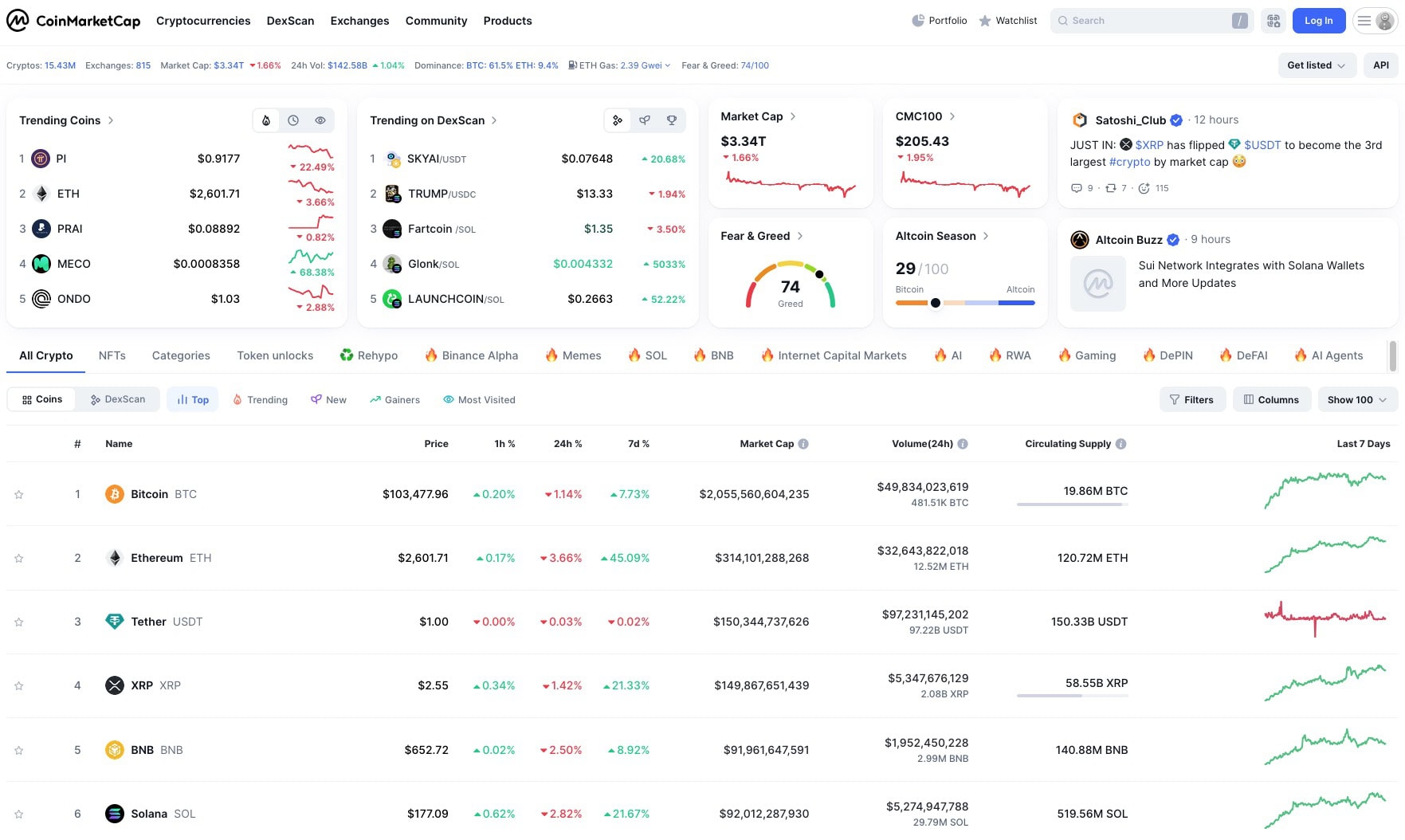

This announcement reversed the hostility that the SEC showed towards the market during the previous four years, and it triggered a favorable international response. The market capitalization of the crypto space is currently just over USD $3 trillion, and there are strong expectations for future growth based on some major trends, as explained in this article.

Cryptocurrency: Increased “Friendly” Regulation

While cryptocurrency enthusiasts have traditionally been wary of regulation, there is now a tendency to see the positive side. Regulation of products and exchanges will lead to certainty and, as a consequence, increased adoption, which is the key for the market to explode globally.

Crypto detractors have pointed out how Bitcoin can be used for money laundering (same as any other currency) and how scams that promise quick wealth have proliferated. Improved transparency will help to legitimize the industry in the eyes of millions of potential investors and provide them with protections similar to those found with other financial products.

Boost in Spot Crypto ETFs Approval

As adoption by financial institutional increases, a wave of Spot Crypto ETFs is coming. While crypto-related ETFs have been circulating for a few years, spot ETFs are more recent. Canada has led the way as the first spot Bitcoin (BTC) ETF was launched in 2021. In the US, the SEC approved its first spot BTC ETF in January, 2024.

Very recently, Canada made news again as it approved the first Solana (SOL) spot ETFs in North America, launched by four issuing firms.

In the US market, the SEC is reviewing dozens of applications for ETF approvals, some by power players in the industry such as Fidelity, Greyscale, and BlackRock. There are currently applications for ETFs featuring coins like Ethereum (ETH), XRP, Hedera (HBAR), Litecoin (LTC), Polkadot (DOT), Avalanche (AVAX), Cardano (ADA), and many others.

Adoption and Asset Tokenization

Digital tokenization of real assets is happening: the rights of ownership of assets (securities, property, metals, etc.) will be stored in the blockchain. This allows access for more investors (“democratization”) and it makes fractional ownership a lot easier.

It also improves liquidity by making assets faster and cheaper to trade. Another benefit will be enhanced transparency as transactions are recorded permanently and can’t be tampered with. These features will benefit individual and institutional investors.

Uneven Emergence of CBDCs Worldwide

A controversial topic involves the use of Central Bank Digital Currencies. These are the digital versions of fiat currencies (USD, CAD, Euro) issued and controlled by a nation’s central bank. Their obvious benefits are transaction efficiency, transparency, and lower costs.

Critics, however, are alarmed by the reduced privacy and increased control that governments could have over an individual’s financial transactions.

Also, the power given to central banks will simplify their implementation of monetary policy, but could also invite economic manipulation.

So far, three countries have fully launched a CBDC: Nigeria, Jamaica, and the Bahamas. Many others are in research and development stages, notably the European Union, India, China, Russia, and Japan.

The Central Bank of Canada announced, in September of 2024, that it will “scale down” its efforts to launch a digital CAD. The US government formalized its rejection of a digital USD in January of 2025.

Multiplication of Meme Coins

These are tokens that are often based in humor and related to a particular “meme” (digital trend). The original meme coin is Dogecoin (DOGE), which was launched in 2013 as a parody to Bitcoin. It became notorious after it was mentioned a few times by Elon Musk, who ironically runs the US Department of Government Efficiency (DOGE).

Few of these coins have actual use cases and their value depends on them being trendy. Their appeal lies in the potential of hyper-explosive gains, given that the price of some of these tokens is a fraction of a cent per unit.

With the “crypto winter” gone, investors need to stay alert and become educated if they wish to take advantage of a potential boom in the upcoming financial revolution.

Legal Disclaimer: the contents of this article are for information purposes only and are not intended to provide any form of financial or investment advice.

Top image: Pixabay

A business professional turned writer, Ricardo has a passion for presenting complex ideas in a reader-friendly way. He has worked for blue chip corporations in Canada, ran a restaurant franchise in Venezuela and developed a papaya farm in the tropical jungles of southern Mexico.

His education includes an MBA, specialized financial training, and a variety of professional writing courses from the University of Toronto. He has published personal finance articles in both English and Spanish.

Ricardo lives in Toronto with his wife and daughter.